Tom T. Hall, famously known as “The Storyteller” of country music, left an indelible mark on the industry with his heartfelt lyrics and timeless storytelling.

Fans and aspiring musicians alike often wonder about Tom T. Hall’s net worth, curious how a songwriter and performer translated creativity into wealth.

Over decades, Hall built a successful career, earning income from songwriting royalties, album sales, live performances, and publishing rights. While estimates of his financials vary, his ability to generate long-term revenue showcases the importance of smart income management for artists.

Beyond celebrating his music, his career also raises a practical question: could someone like Tom T. Hall have boosted their wealth further through financial planning, such as opening an IRA?

Understanding the connection between his earnings, royalties, and retirement options offers valuable lessons for musicians, songwriters, and self-employed creatives looking to secure their financial future.

Who Was Tom T. Hall? – Early Life & Background

Tom T. Hall was born on May 25, 1936, in Olive Hill, Kentucky, a small town that shaped his storytelling perspective and lyrical style. Growing up in rural America, Hall was deeply influenced by the everyday experiences, people, and culture around him. His early exposure to country music and folk traditions inspired him to write songs that captured real-life stories, earning him the nickname “The Storyteller.”

Before his rise to fame, Hall pursued education and briefly worked in advertising, which helped him understand the business side of creative work—a skill that would later impact his earnings and net worth. He began writing songs for other artists, honing his craft and learning the intricacies of royalties, publishing rights, and performance income. These early career choices laid the foundation for a long-lasting financial legacy, demonstrating how songwriting royalties and creative ownership can significantly contribute to wealth accumulation for artists.

Hall’s breakthrough came in the late 1960s and early 1970s, when he wrote and performed hits that resonated nationwide. His ability to weave personal experiences into songs not only endeared him to fans but also ensured a consistent stream of income, establishing him as one of country music’s most financially successful and influential songwriters. Understanding his early life gives insight into how his career decisions impacted both his financial success and potential retirement planning opportunities, like opening an IRA.

Career Highlights That Built His Wealth

Tom T. Hall’s career was a masterclass in turning talent into sustainable wealth. Known for his narrative songwriting, Hall wrote hits not only for himself but also for other country music stars, creating multiple streams of income. His songs, such as chart-toppers like “Harper Valley PTA” and “I Love”, earned him consistent royalty payments, which remain a significant component of his net worth.

Beyond songwriting, Hall enjoyed a successful performing career. His albums regularly charted, and his live performances drew large audiences, generating revenue from ticket sales and merchandise. He received numerous accolades, including inductions into the Country Music Hall of Fame and multiple Grammy nominations, which further solidified his brand and earning potential. Each achievement contributed to a growing financial foundation, showcasing how diversifying income sources—through both royalties and live performances—can maximize wealth.

Hall also understood the importance of music publishing rights, ensuring that he retained control over his songs. This decision not only increased his long-term income but also provided a form of passive revenue, a critical factor for any artist seeking financial stability. His career highlights demonstrate that success in the music industry isn’t just about fame—it’s about strategic decisions that impact earnings, financial growth, and even potential retirement planning. For self-employed creatives, Hall’s journey offers a blueprint for combining talent with smart money management, potentially even using tools like an IRA to secure long-term financial security.

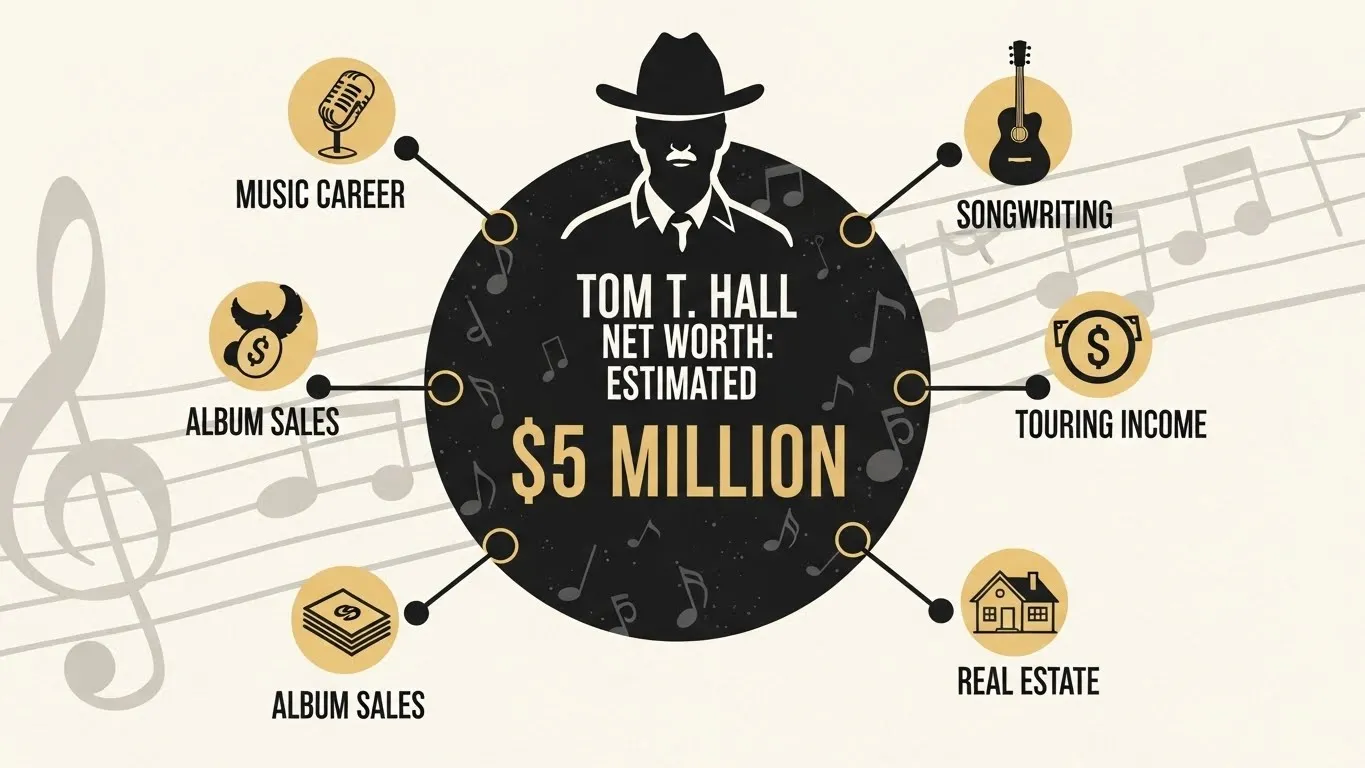

Tom T. Hall Net Worth Overview

Estimating Tom T. Hall’s net worth requires examining his decades-long career as a songwriter, performer, and storyteller. While exact figures vary, most sources estimate his wealth to be in the range of $5 million to $10 million, with some reports suggesting it could have reached $20 million. These differences stem from variations in accounting for royalties, publishing rights, and other income streams. Regardless of the exact number, it’s clear that Hall’s financial success was built on consistent earnings and smart management of his music assets.

Hall’s net worth reflects multiple income sources. Songwriting royalties provided a steady stream of passive income, while album sales and live performances added active revenue. Publishing rights, in particular, ensured that he continued earning from songs he wrote decades earlier, demonstrating the long-term financial benefits of intellectual property in the music industry. His careful control over these rights contributed significantly to his overall financials, setting him apart from many artists who rely solely on performance income.

Compared to other country music legends of his era, Hall’s wealth was modest but stable, highlighting the importance of long-term planning over short-term earnings. By understanding his net worth, fans and aspiring musicians can see the financial impact of combining creative talent with strategic income management. Moreover, Hall’s financial journey raises interesting considerations for retirement planning, including options like opening an IRA to grow wealth even further over time.

Main Sources of Tom T. Hall’s Income

Tom T. Hall’s financial success was built on a diverse mix of income streams, illustrating how artists can generate both active and passive revenue. The most significant source of his wealth came from songwriting royalties. Hall wrote hundreds of songs, many of which were recorded by himself and other artists. Each time these songs were sold, streamed, or played on the radio, he earned royalties—a long-term income stream that contributed consistently to his net worth.

Another major income source was album sales. Hall released multiple albums that achieved commercial success, providing direct revenue and boosting his visibility in the country music scene. This exposure, in turn, increased performance opportunities and royalty income. Speaking of performances, touring and live shows were also a critical part of his earnings. Concerts brought in ticket sales, merchandise revenue, and performance fees, creating an additional active income stream.

Publishing rights were equally important. By retaining control over his songs, Hall ensured that he received payments whenever his music was licensed for television, movies, or cover versions by other artists. This smart approach to intellectual property protected his financial future, much like modern artists who prioritize ownership of their work.

In addition to music-related income, Hall occasionally earned from media appearances, interviews, and public speaking engagements, further supplementing his wealth. Altogether, these income sources—royalties, albums, tours, and publishing rights—formed a robust financial foundation that not only supported his lifestyle but also contributed to potential retirement savings, including options like an IRA.

FAQs

1. What was Tom T. Hall’s net worth?

Tom T. Hall’s net worth is estimated between $5 million and $20 million, depending on the source. His wealth came from a combination of songwriting royalties, album sales, tours, and publishing rights.

2. How did Tom T. Hall make his money?

Hall earned income primarily through songwriting royalties, performing live, selling albums, and licensing his music for media. Retaining publishing rights was key to his long-term financial stability.

3. Can musicians open an IRA?

Yes. Any musician with earned income—including royalties or performance fees—can open an IRA to save for retirement. IRAs offer tax advantages and help self-employed artists grow wealth.

4. Are royalties considered earned income for IRA purposes?

Yes, royalties that come from active work, such as songwriting, can count as earned income when contributing to an IRA. Passive royalty income may require careful reporting for IRA eligibility.

5. What IRA is best for musicians and songwriters?

It depends on your financial goals:

Traditional IRA: Tax-deductible contributions, tax-deferred growth.

Roth IRA: Contributions after-tax, tax-free withdrawals in retirement.Musicians with fluctuating income may benefit from consulting a financial advisor to choose the best option.

6. How can artists maximize their wealth like Tom T. Hall?

Artists should diversify income streams, retain ownership of their work, manage royalties wisely, and consider retirement accounts like IRAs to grow wealth over time.

Conclusion

Tom T. Hall’s legacy as “The Storyteller” extends far beyond his music his career also offers valuable lessons in financial planning and wealth management.

With an estimated net worth between $5 million and $20 million, Hall built his wealth through a combination of songwriting royalties, album sales, touring, and publishing rights.

By retaining control over his music and diversifying income streams, he ensured long-term financial stability, proving that strategic decisions are just as important as talent in building lasting wealth.

For modern musicians, songwriters, and self-employed creatives, Hall’s journey highlights the importance of planning for the future.

Tools like a Traditional or Roth IRA can complement earnings from royalties and performances, providing tax advantages and a secure path to retirement.

Even modest, consistent contributions over time can grow significantly, just as Hall’s smart management of royalties compounded into a substantial legacy.

Ultimately, Tom T. Hall’s story demonstrates that creativity paired with financial foresight can create both artistic and financial success.

By learning from his approach to income, rights management, and potential retirement planning, aspiring artists can chart a course toward long-term wealth and financial independence.

I am Ethan Blake, a passionate writer dedicated to crafting heartfelt messages that spread love, joy, and inspiration.