In the rapidly evolving world of robotics and prosthetics, Psyonic has emerged as a groundbreaking company, blending cutting-edge technology with real-world impact. Known for its innovative prosthetic devices, Psyonic is transforming the lives of individuals who rely on advanced assistive technologies. But beyond its technological achievements, one question often arises: what is Psyonic’s net worth?

Understanding a company’s financial standing provides insight into its growth, market influence, and long-term potential.

From venture capital investments to revenue streams and product success, Psyonic’s valuation reflects both its technological prowess and its strategic business decisions. In this article, we dive deep into the financial world of Psyonic, exploring its revenue, funding history, investor backing, and industry position.

If you are an investor, tech enthusiast, or simply curious, this comprehensive guide will shed light on Psyonic’s current financial worth and its trajectory for the future

Company Overview

Psyonic, founded with the mission to revolutionize prosthetic technology, has quickly become a standout name in the robotics and assistive device industry. The company focuses on designing and producing high-performance prosthetic hands and robotic solutions that combine affordability with advanced functionality. At its core, Psyonic is driven by a vision to make cutting-edge prosthetic technology accessible to individuals worldwide, improving both mobility and quality of life.

Since its inception, Psyonic has achieved several key milestones. The company has launched flagship products, including multi-articulating prosthetic hands that offer unprecedented dexterity and responsiveness. These innovations set Psyonic apart from competitors, as the devices integrate seamlessly with users’ natural movements, thanks to sophisticated sensor technology. Beyond product development, Psyonic has secured multiple patents and formed strategic partnerships with healthcare institutions, technology firms, and research organizations.

Psyonic’s focus on research and development has been a major factor in its success. By investing heavily in innovation, the company continuously improves its product offerings, ensuring it stays at the forefront of the prosthetics market. This combination of technological excellence, strategic growth, and a user-centered approach has positioned Psyonic as a leader in its field, attracting both customers and investors who recognize the company’s potential. Understanding Psyonic’s foundation, products, and mission is crucial for appreciating the factors that influence its net worth and market valuation.

Revenue Streams

Psyonic generates revenue through a variety of channels, reflecting the company’s diverse approach to the prosthetics and robotics market. The primary source of income comes from the sale of its flagship prosthetic devices, which include multi-articulating robotic hands designed for both adults and children. These devices are sold directly to consumers, as well as through partnerships with hospitals, rehabilitation centers, and prosthetic clinics. The growing demand for affordable, high-quality prosthetics has allowed Psyonic to capture a significant share of the market, driving consistent revenue growth year over year.

In addition to product sales, Psyonic benefits from secondary revenue streams. These include licensing deals, where other companies use Psyonic’s patented technologies in their own products, and research collaborations funded by universities, hospitals, and government agencies. Grants and innovation-focused funding also contribute to the company’s financial stability, particularly for research and development projects aimed at next-generation prosthetic technology.

The company’s revenue growth reflects both market demand and strategic investment in innovation. By continually enhancing product capabilities and expanding into new markets, Psyonic strengthens its financial position. Furthermore, its focus on accessibility—offering cost-effective solutions without compromising quality—broadens its customer base and ensures sustainable income.

Understanding Psyonic’s revenue streams provides a clear picture of how the company earns its net worth and highlights the balance between direct sales, licensing, and research-based funding. These diverse income sources collectively support Psyonic’s growth, market presence, and long-term valuation in the competitive prosthetics industry.

Investments & Funding

A critical factor behind Psyonic’s growth and valuation is its strong foundation of investments and funding. From the early stages, the company attracted attention from venture capitalists and angel investors who recognized its potential to transform the prosthetics and robotics industry. These early investments provided the capital necessary to develop advanced prosthetic devices, expand research capabilities, and bring innovative products to market.

Psyonic has completed multiple funding rounds, each contributing to its increasing valuation. Investors are drawn not only to the company’s cutting-edge technology but also to its mission-driven approach, which combines social impact with profitability. Strategic partnerships with healthcare institutions and technology firms further enhance Psyonic’s financial stability and support long-term growth initiatives.

Beyond traditional investment, Psyonic has also benefited from grants and research-based funding. Government agencies, nonprofit organizations, and innovation programs have supported the company’s R&D projects, enabling the development of next-generation prosthetic devices. These funds allow Psyonic to explore new technologies, such as advanced sensors and AI-driven control systems, without relying solely on product sales.

Additionally, Psyonic’s commitment to research and development demonstrates how investment in innovation directly impacts valuation. By continuously improving product functionality and expanding its technological portfolio, the company strengthens its market position and appeal to investors. Collectively, venture capital, grants, and R&D investment form the backbone of Psyonic’s financial structure, supporting both current operations and future growth. Understanding this funding landscape is key to appreciating the factors driving Psyonic’s net worth and market potential.

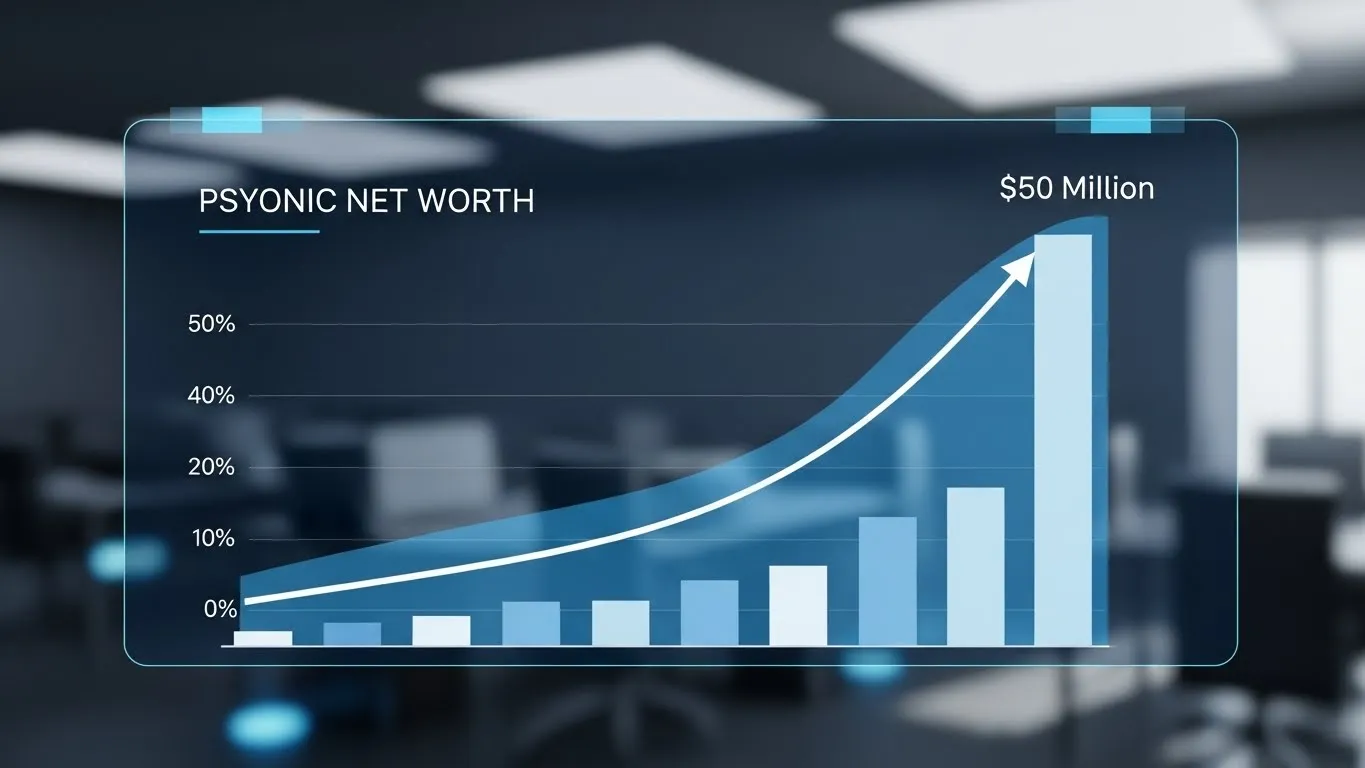

Valuation & Net Worth

Estimating Psyonic’s net worth provides valuable insight into the company’s financial standing and market influence. While Psyonic is privately held and does not publicly disclose its full financial statements, analysts and industry reports can offer a close approximation based on revenue, investments, and market positioning. The company’s net worth is driven primarily by its innovative prosthetic devices, strategic partnerships, and strong intellectual property portfolio, including patents on advanced robotic hands.

Industry experts often use valuation methods such as revenue multiples and comparable company analysis to estimate Psyonic’s worth. By comparing Psyonic to other robotics and prosthetics companies, it becomes clear that its commitment to accessibility, R&D, and product innovation significantly enhances its market valuation. The influx of venture capital and funding rounds further boosts the company’s financial profile, reflecting investor confidence in Psyonic’s long-term growth potential.

Psyonic’s net worth is not solely a reflection of financial figures; it also incorporates brand reputation, technological leadership, and market influence. These qualitative factors contribute to investor perception and help position Psyonic as a competitive force in the prosthetics industry.

Understanding Psyonic’s net worth requires considering both tangible assets, like revenue and investment, and intangible value, such as intellectual property and industry impact. Combined, these factors highlight why Psyonic is increasingly recognized as a pioneering company in robotics and prosthetic innovation, with a growing valuation that reflects both current achievements and future potential.

Public Perception & Brand Influence

Beyond financial metrics, Psyonic’s influence is shaped significantly by its public perception and brand reputation. Media coverage has played a pivotal role in highlighting the company’s innovations and social impact. Articles, press releases, and tech features often emphasize Psyonic’s mission to make advanced prosthetic technology accessible and affordable, reinforcing its image as a socially conscious and innovative company. Recognition from industry awards and technology showcases further enhances the brand’s credibility and visibility.

Customer feedback is another vital aspect of Psyonic’s public influence. Users consistently praise the company’s prosthetic devices for their dexterity, responsiveness, and user-friendly design. Testimonials and case studies illustrate how Psyonic products improve daily life, from restoring mobility to enabling more precise motor control. Positive reviews not only strengthen consumer trust but also support investor confidence, as satisfied users reflect the company’s ability to deliver real-world impact.

Within the industry, Psyonic has established itself as a thought leader and innovator. Its research initiatives, patents, and collaborations with universities and healthcare institutions demonstrate a commitment to advancing prosthetic technology. By contributing to technological development and shaping industry standards, Psyonic’s influence extends beyond direct sales—it helps define the future of robotic prosthetics.

Ultimately, public perception and brand influence complement Psyonic’s financial success. The combination of media recognition, positive customer experiences, and industry impact enhances the company’s overall valuation and positions Psyonic as a trusted and pioneering name in the prosthetics and robotics market.

Future Projections

Looking ahead, Psyonic is positioned for continued growth in the rapidly expanding prosthetics and robotics market. With increasing global demand for advanced, affordable prosthetic solutions, the company has significant opportunities to expand both its product lines and market reach. Innovations in sensor technology, AI integration, and multi-articulating prosthetic designs are expected to drive the next wave of product development, improving functionality and user experience.

Psyonic’s growth strategy also includes expanding into international markets, particularly regions where access to advanced prosthetic technology has been limited. By leveraging partnerships with healthcare providers, NGOs, and government programs, the company can reach a broader customer base while simultaneously increasing revenue. Additionally, potential collaborations with research institutions and technology firms may accelerate innovation and open doors to new applications of Psyonic’s core technology.

However, growth comes with challenges. The company faces competition from established prosthetic manufacturers and emerging startups, regulatory hurdles in global markets, and the need to maintain affordability while scaling production. Economic fluctuations and changes in healthcare funding could also impact revenue streams.

Despite these risks, Psyonic’s strong foundation—built on innovation, strategic funding, and a clear mission—provides a solid platform for sustainable growth. Analysts predict that continued investment in R&D, combined with strategic partnerships and market expansion, will enhance Psyonic’s valuation and solidify its reputation as a leading force in prosthetic and robotic technology

Conclusion

Psyonic has emerged as a pioneering force in the prosthetics and robotics industry, combining technological innovation with a mission-driven approach.

From its cutting-edge multi-articulating prosthetic hands to strategic partnerships and strong investor backing, the company has built a foundation that supports both growth and long-term sustainability.

Its net worth reflects not only revenue and funding but also intangible assets such as intellectual property, brand reputation, and industry influence.

I am Ethan Blake, a passionate writer dedicated to crafting heartfelt messages that spread love, joy, and inspiration.